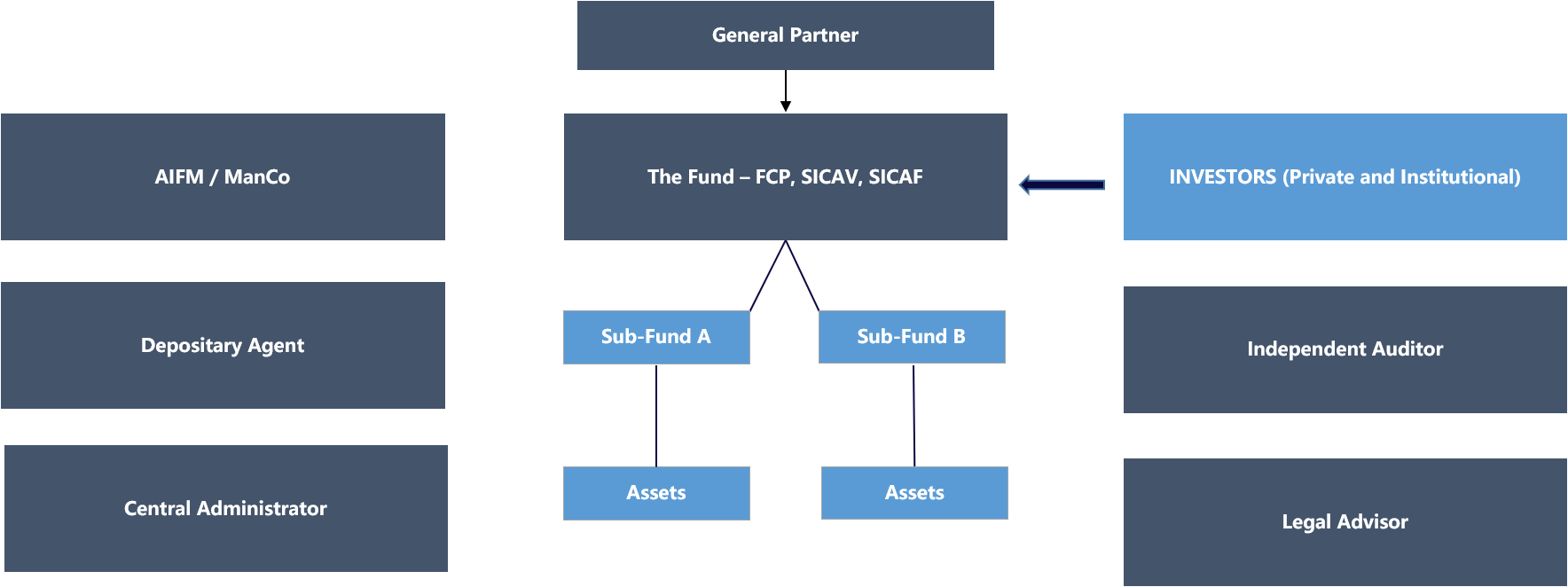

Advantages of the structure: Low subscription tax of 0,01%; No wealth tax; Minimum required capital of EUR 1,25M; Diversified portfolio; Cost efficiency; Possibility of listing; No income tax.

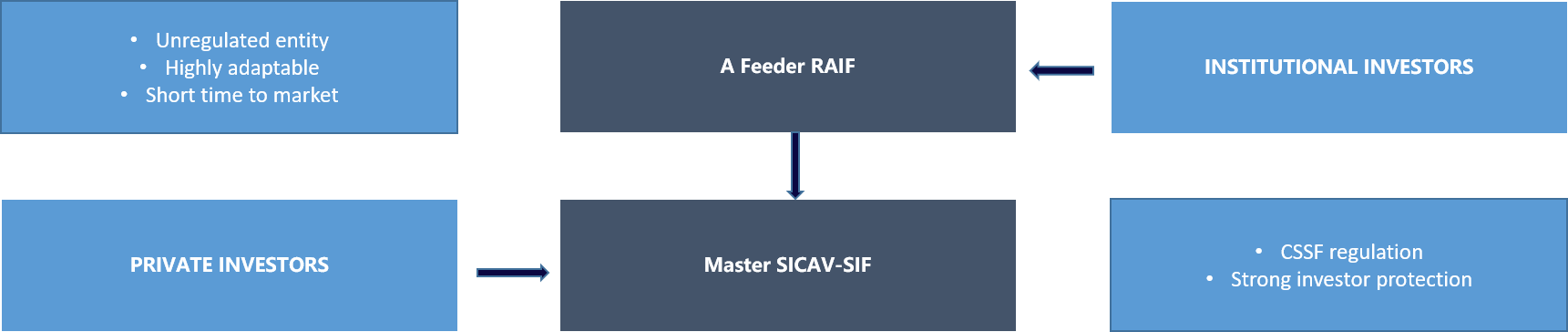

Advantages of the structure: No subscription tax at Feeder level; Separate AGM; Consolidation of various portfolios into one entity; Investor comfort and regulatory supervision for private investors; Convenient investor management; Cost efficiency

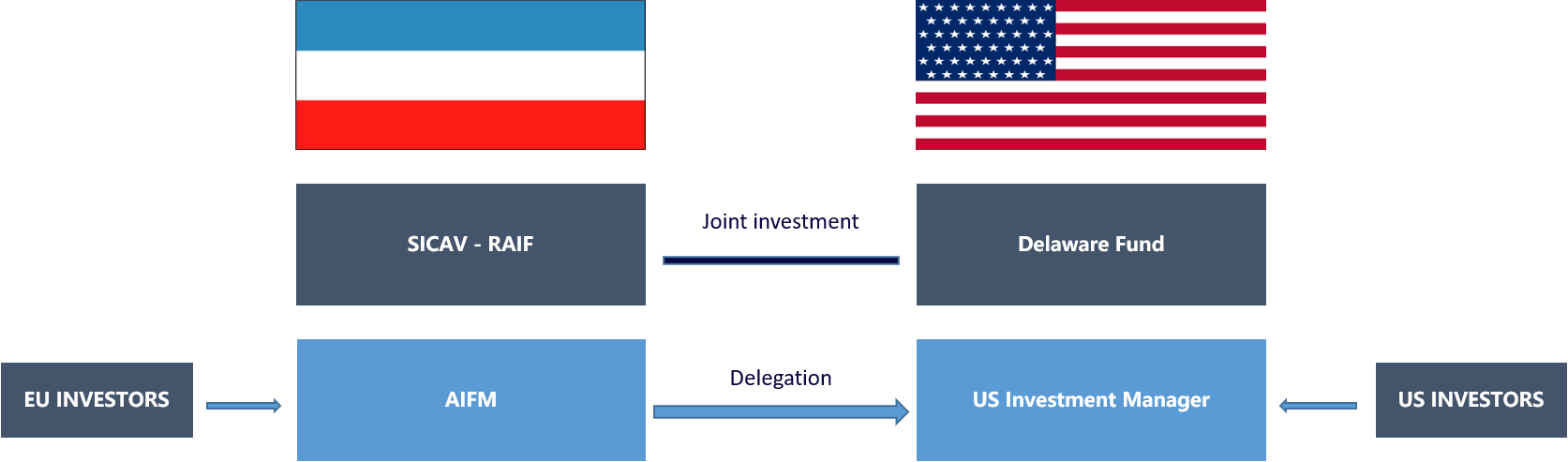

Advantages of the structure: Marketing passport ensured by the AIFMD; Access to EU market space granted to US Investment Managers; Joint investment process

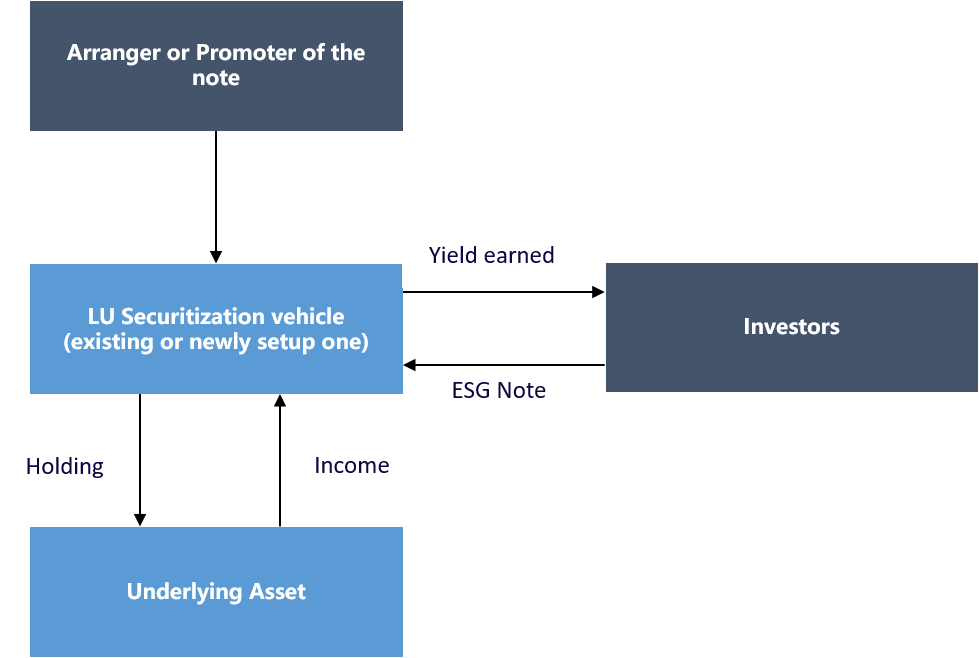

Advantages of the structure: Consolidating a pool of assets and offering the entire portfolio to investors; Funding an investment by raising capital together with other investors; Unrestricted eligibility of investors; Economy of scale; No subscription tax; No wealth tax

Advantages of the structure: Low set-up fees, as rental; No wealth tax; No minimum required capital; Usage of an established structure; Unlimited types of investment strategies.

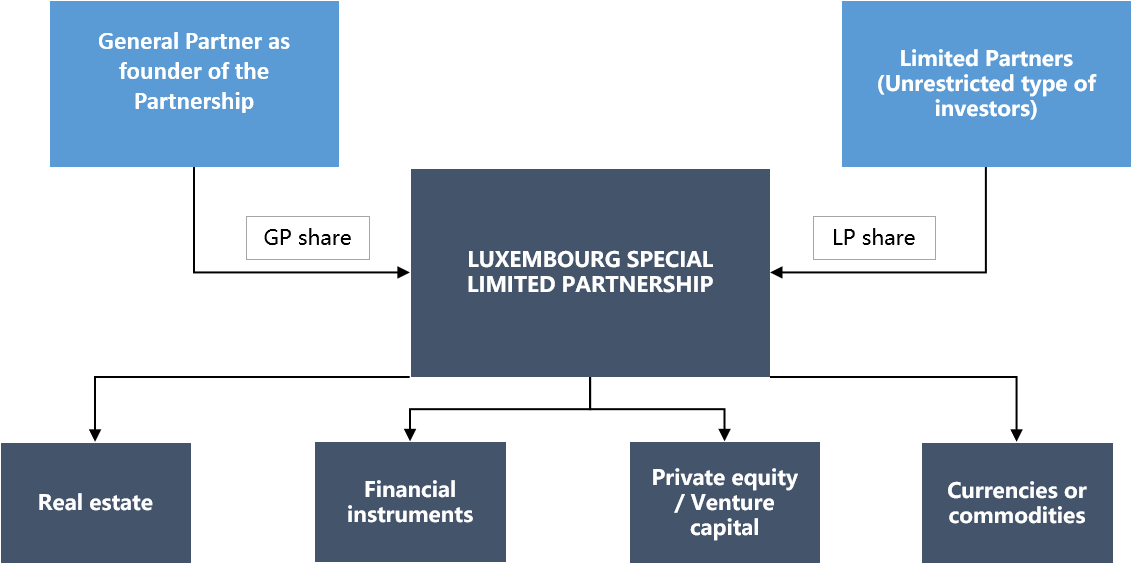

Advantages of the structure: The Special Limited Partnerships (SLPs) are used to invest in all types of assets, as a special purpose vehicle (SPV), a co-investment entity for institutional investors or co-ownership between family offices, wealthy individuals and other entities; No risk diversification; No minimum capital requirement

The Luxembourg private wealth management company (hereafter: SPF – société de gestion de patrimoine familial), governed by the Law of 11 May 2007, is a private wealth management vehicle which enables individuals to structure their estate in a simple, flexible, unregulated and tax-efficient manner and for numerous purposes, thereby appealing to various types of investors. Ultimately, with Luxembourg being a highly developed centre of legal and financial services, private individuals willing to structure their asset holdings from an end-to-end perspective, have all their expectations met.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Thales Capital Luxembourg is a licensed, independent advisor specialized in private capital management, fund structuring, governance, investments and capital raising.

2 Place de Strasbourg L-2562 Luxembourg Luxembourg

+352 20 33 40 30

+352 621 624 969

+352 621 827 628

structuring@thales.lu

Thank you for submitting your form. Your submission has been received and will be reviewed as soon as possible. If we require any further information, we will contact you. Thank you for your time and cooperation.